Life As a Financial Examiner

Financial Examiner Job Description Enforce or ensure compliance with laws and regulations governing financial and securities institutions and financial and real estate transactions. May examine, verify, or authenticate records.

What Do Financial Examiners Do On a Daily Basis?

- Direct and participate in formal and informal meetings with bank directors, trustees, senior management, counsels, outside accountants and consultants to gather information and discuss findings.

- Review balance sheets, operating income and expense accounts, and loan documentation to confirm institution assets and liabilities.

- Provide regulatory compliance training to employees.

- Resolve problems concerning the overall financial integrity of banking institutions including loan investment portfolios, capital, earnings, and specific or large troubled accounts.

- Examine the minutes of meetings of directors, stockholders and committees to investigate the specific authority extended at various levels of management.

- Confer with officials of real estate, securities, or financial institution industries to exchange views and discuss issues or pending cases.

Financial Examiner Required Skills

Financial Examiners state the following job skills are important in their day-to-day work.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Speaking: Talking to others to convey information effectively.

Related Job Titles

- Principal Examiner

- Compliance Specialist

- Treasury Analyst

- Internal Auditor

- Bank Compliance Officer

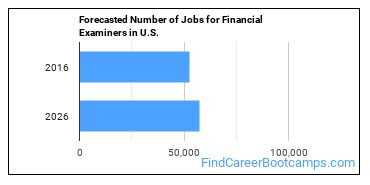

Job Demand for Financial Examiners

In the United States, there were 52,500 jobs for Financial Examiner in 2016. New jobs are being produced at a rate of 9.7% which is above the national average. The Bureau of Labor Statistics predicts 5,100 new jobs for Financial Examiner by 2026. Due to new job openings and attrition, there will be an average of 4,600 job openings in this field each year.

The states with the most job growth for Financial Examiner are Arizona, Florida, and Idaho. Watch out if you plan on working in Wyoming, Mississippi, or Maryland. These states have the worst job growth for this type of profession.

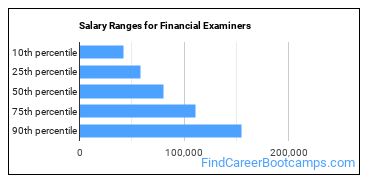

What is the Average Salary of a Financial Examiner

The average yearly salary of a Financial Examiner ranges between $42,150 and $154,590.

Financial Examiners who work in District of Columbia, Connecticut, or New York, make the highest salaries.

Below is a list of the median annual salaries for Financial Examiners in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $59,910 |

| Alaska | $71,830 |

| Arizona | $61,710 |

| Arkansas | $70,640 |

| California | $108,740 |

| Colorado | $82,380 |

| Connecticut | $108,520 |

| Delaware | $85,610 |

| District of Columbia | $157,860 |

| Florida | $85,580 |

| Georgia | $106,870 |

| Hawaii | $64,380 |

| Idaho | $74,390 |

| Illinois | $102,690 |

| Indiana | $74,140 |

| Iowa | $65,410 |

| Kansas | $74,360 |

| Kentucky | $64,400 |

| Louisiana | $100,420 |

| Maine | $66,720 |

| Maryland | $77,440 |

| Massachusetts | $107,840 |

| Michigan | $81,270 |

| Minnesota | $91,530 |

| Mississippi | $81,800 |

| Missouri | $73,870 |

| Montana | $70,180 |

| Nebraska | $71,790 |

| Nevada | $67,820 |

| New Hampshire | $91,330 |

| New Jersey | $109,100 |

| New Mexico | $84,370 |

| New York | $115,980 |

| North Carolina | $71,310 |

| North Dakota | $75,770 |

| Ohio | $78,540 |

| Oklahoma | $70,250 |

| Oregon | $67,980 |

| Pennsylvania | $91,850 |

| Rhode Island | $89,470 |

| South Carolina | $65,720 |

| South Dakota | $86,920 |

| Tennessee | $83,170 |

| Texas | $84,350 |

| Utah | $71,220 |

| Vermont | $76,670 |

| Virginia | $80,700 |

| Washington | $95,910 |

| West Virginia | $68,940 |

| Wisconsin | $76,680 |

Tools & Technologies Used by Financial Examiners

Below is a list of the types of tools and technologies that Financial Examiners may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- Word processing software

- SAP

- Microsoft Windows

- Microsoft Project

- Spreadsheet software

- Microsoft Visio

- Microsoft SharePoint

- Structured query language SQL

- LexisNexis

- Presentation software

- Westlaw

- Financial compliance software

- Auditing software

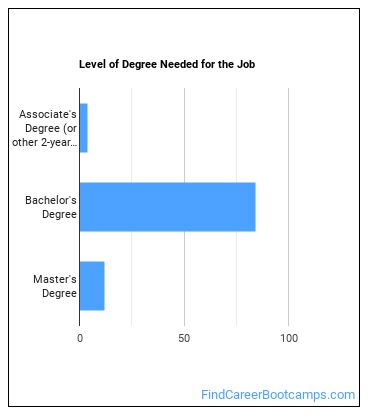

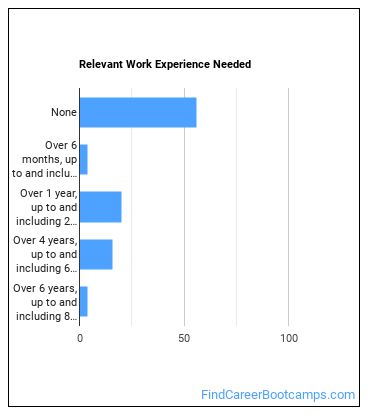

Becoming a Financial Examiner

Are there Financial Examiners education requirements?

How Long Does it Take to Become a Financial Examiner?

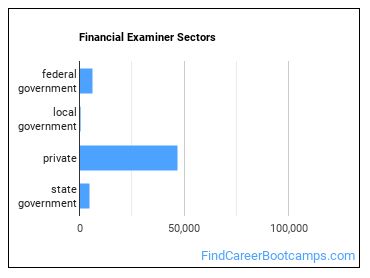

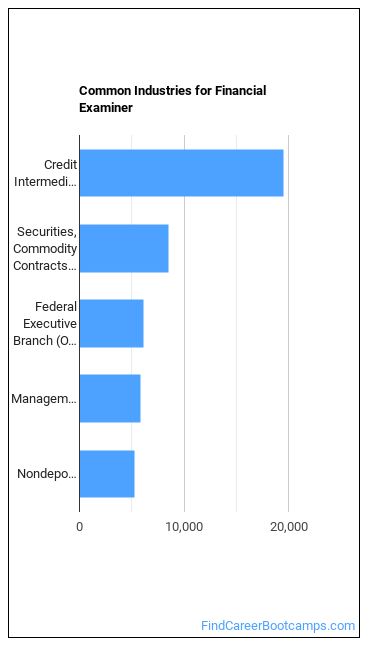

Financial Examiners Sector

The table below shows some of the most common industries where those employed in this career field work.

Other Jobs You May be Interested In

Those thinking about becoming a Financial Examiner might also be interested in the following careers:

- Administrative Law Judges, Adjudicators, and Hearing Officers

- Claims Examiners, Property and Casualty Insurance

Are you already one of the many Financial Examiner in the United States? If you’re thinking about changing careers, these fields are worth exploring:

References:

Image Credit: Pixabay via CC0 License

More about our data sources and methodologies.