What Does it Take to Be a Personal Financial Advisor?

Personal Financial Advisor Example Advise clients on financial plans using knowledge of tax and investment strategies, securities, insurance, pension plans, and real estate. Duties include assessing clients’ assets, liabilities, cash flow, insurance coverage, tax status, and financial objectives.

A Day in the Life of a Personal Financial Advisor

- Manage client portfolios, keeping client plans up-to-date.

- Conduct seminars or workshops on financial planning topics, such as retirement planning, estate planning, or the evaluation of severance packages.

- Prepare or interpret for clients information such as investment performance reports, financial document summaries, or income projections.

- Inform clients about tax benefits, government rebates, or other financial benefits of alternative fuel vehicle purchases or energy efficient home construction, improvements, or remodeling.

- Guide clients in the gathering of information, such as bank account records, income tax returns, life and disability insurance records, pension plans, or wills.

- Implement financial planning recommendations or refer clients to someone who can assist them with plan implementation.

Skills Needed to be a Personal Financial Advisor

Personal Financial Advisors state the following job skills are important in their day-to-day work.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Speaking: Talking to others to convey information effectively.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Service Orientation: Actively looking for ways to help people.

Types of Personal Financial Advisor

- Investment Advisor

- Budget Counselor

- Asset Manager

- Personal Banker

- Chartered Financial Analyst (CFA)

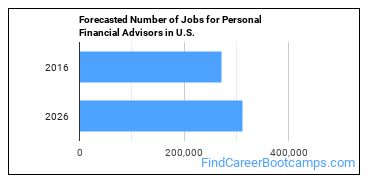

Job Opportunities for Personal Financial Advisors

There were about 271,900 jobs for Personal Financial Advisor in 2016 (in the United States). New jobs are being produced at a rate of 14.9% which is above the national average. The Bureau of Labor Statistics predicts 40,400 new jobs for Personal Financial Advisor by 2026. The BLS estimates 25,500 yearly job openings in this field.

The states with the most job growth for Personal Financial Advisor are Colorado, Delaware, and Arizona. Watch out if you plan on working in Maine, New Jersey, or Massachusetts. These states have the worst job growth for this type of profession.

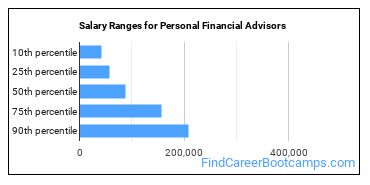

Salary for a Personal Financial Advisor

Personal Financial Advisors make between $41,590 and $208,000 a year.

Personal Financial Advisors who work in New York, District of Columbia, or New Jersey, make the highest salaries.

How much do Personal Financial Advisors make in each U.S. state?

| State | Annual Mean Salary |

|---|---|

| Alabama | $117,350 |

| Alaska | $93,530 |

| Arizona | $107,160 |

| Arkansas | $96,600 |

| California | $128,730 |

| Colorado | $103,540 |

| Connecticut | $131,280 |

| Delaware | $126,880 |

| District of Columbia | $158,460 |

| Florida | $122,840 |

| Georgia | $121,420 |

| Hawaii | $81,700 |

| Idaho | $104,640 |

| Illinois | $126,640 |

| Indiana | $111,330 |

| Iowa | $105,540 |

| Kansas | $93,720 |

| Kentucky | $85,470 |

| Louisiana | $92,300 |

| Maine | $135,170 |

| Maryland | $110,080 |

| Massachusetts | $128,140 |

| Michigan | $102,010 |

| Minnesota | $99,490 |

| Mississippi | $102,820 |

| Missouri | $85,830 |

| Montana | $102,730 |

| Nebraska | $85,890 |

| Nevada | $108,540 |

| New Hampshire | $105,010 |

| New Jersey | $127,150 |

| New Mexico | $133,500 |

| New York | $164,260 |

| North Carolina | $134,860 |

| North Dakota | $100,360 |

| Ohio | $102,300 |

| Oklahoma | $74,340 |

| Oregon | $117,730 |

| Pennsylvania | $109,250 |

| Rhode Island | $112,430 |

| South Carolina | $89,830 |

| South Dakota | $77,490 |

| Tennessee | $89,960 |

| Texas | $110,820 |

| Utah | $88,440 |

| Vermont | $85,150 |

| Virginia | $121,250 |

| Washington | $109,870 |

| West Virginia | $95,210 |

| Wisconsin | $115,820 |

| Wyoming | $135,340 |

What Tools do Personal Financial Advisors Use?

Below is a list of the types of tools and technologies that Personal Financial Advisors may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Web browser software

- Microsoft Access

- Structured query language SQL

- Microsoft Dynamics

- FileMaker Pro

- Salesforce software

- Oracle E-Business Suite Financials

- Oracle Hyperion

- Sage 50 Accounting

- IBM Domino

- Oracle PeopleSoft Financials

- Fund accounting software

- IBM Lotus 1-2-3

- Swift

- Practice management software PMS

- Intuit Quicken

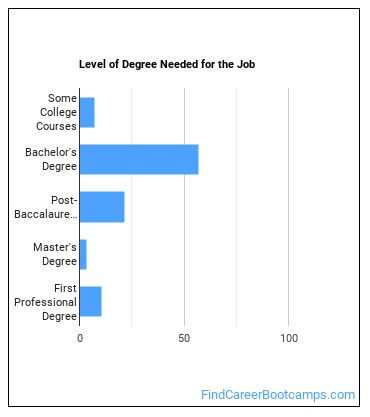

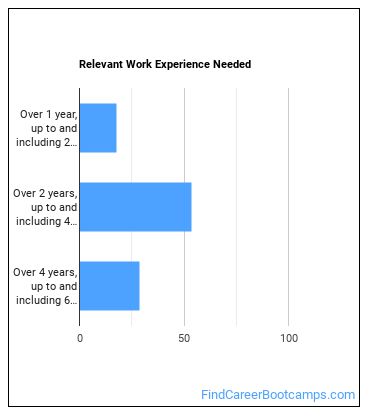

How do I Become a Personal Financial Advisor?

What kind of Personal Financial Advisor requirements are there?

How Long Does it Take to Become a Personal Financial Advisor?

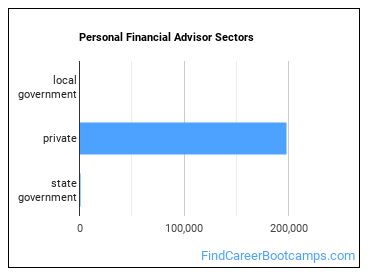

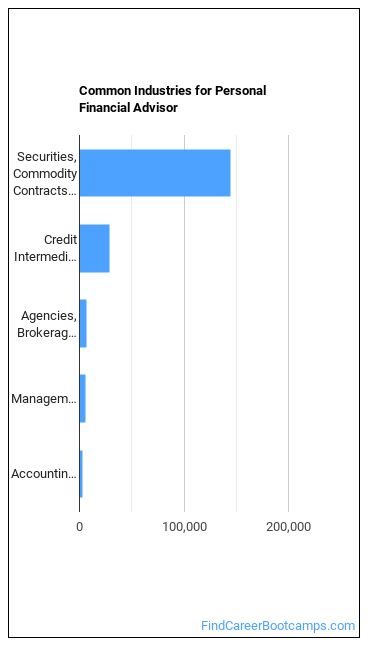

Personal Financial Advisors Sector

Personal Financial Advisors work in the following industries:

Similar Careers

Those interested in being a Personal Financial Advisor may also be interested in:

Are you already one of the many Personal Financial Advisor in the United States? If you’re thinking about changing careers, these fields are worth exploring:

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.