Life As a Loan Counselor

Loan Counselor Example Provide guidance to prospective loan applicants who have problems qualifying for traditional loans. Guidance may include determining the best type of loan and explaining loan requirements or restrictions.

Loan Counselor Responsibilities

- Calculate amount of debt and funds available to plan methods of payoff and to estimate time for debt liquidation.

- Supervise loan personnel.

- Maintain current knowledge of credit regulations.

- Establish payment priorities according to credit terms and interest rates to reduce clients’ overall costs.

- Counsel clients on personal and family financial problems, such as excessive spending or borrowing of funds.

- Analyze potential loan markets to find opportunities to promote loans and financial services.

What a Loan Counselor Should Know

Loan Counselors state the following job skills are important in their day-to-day work.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Related Job Titles

- Financial Assistance Specialist

- Commercial Lending Vice President

- Financial Aid Technician

- Loan Counselor

- Financial Assistance Advisor

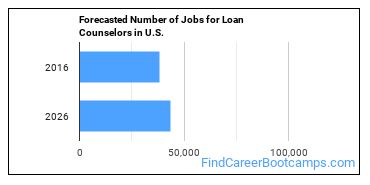

Loan Counselor Job Outlook

There were about 38,300 jobs for Loan Counselor in 2016 (in the United States). New jobs are being produced at a rate of 13.8% which is above the national average. The Bureau of Labor Statistics predicts 5,300 new jobs for Loan Counselor by 2026. The BLS estimates 3,800 yearly job openings in this field.

The states with the most job growth for Loan Counselor are Utah, North Dakota, and Idaho. Watch out if you plan on working in Wyoming, Vermont, or Maine. These states have the worst job growth for this type of profession.

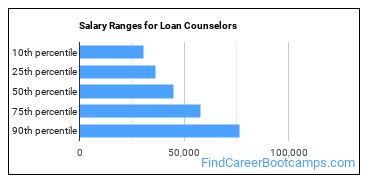

Salary for a Loan Counselor

The typical yearly salary for Loan Counselors is somewhere between $30,440 and $76,690.

Loan Counselors who work in District of Columbia, New Jersey, or Nevada, make the highest salaries.

How much do Loan Counselors make in each U.S. state?

| State | Annual Mean Salary |

|---|---|

| Alabama | $48,260 |

| Arizona | $45,880 |

| Arkansas | $49,770 |

| California | $53,170 |

| Connecticut | $57,500 |

| Delaware | $52,360 |

| District of Columbia | $77,690 |

| Florida | $45,530 |

| Georgia | $51,720 |

| Hawaii | $47,810 |

| Idaho | $42,490 |

| Illinois | $47,290 |

| Indiana | $45,030 |

| Iowa | $43,690 |

| Kansas | $47,910 |

| Kentucky | $44,590 |

| Louisiana | $36,840 |

| Maine | $40,880 |

| Maryland | $47,330 |

| Massachusetts | $57,600 |

| Michigan | $48,340 |

| Minnesota | $51,190 |

| Mississippi | $42,660 |

| Missouri | $53,250 |

| Montana | $44,540 |

| Nevada | $56,510 |

| New Hampshire | $45,850 |

| New Jersey | $68,360 |

| New Mexico | $37,870 |

| New York | $60,520 |

| North Carolina | $54,400 |

| North Dakota | $43,330 |

| Ohio | $51,200 |

| Oklahoma | $42,290 |

| Oregon | $48,090 |

| Pennsylvania | $55,770 |

| Rhode Island | $59,760 |

| South Carolina | $45,320 |

| South Dakota | $38,900 |

| Tennessee | $48,560 |

| Texas | $46,160 |

| Utah | $38,070 |

| Virginia | $50,860 |

| Washington | $48,230 |

| West Virginia | $38,910 |

| Wisconsin | $39,860 |

| Wyoming | $50,960 |

Tools & Technologies Used by Loan Counselors

Although they’re not necessarily needed for all jobs, the following technologies are used by many Loan Counselors:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Web browser software

- Microsoft Access

- Data entry software

- SAP

- FileMaker Pro

- Oracle PeopleSoft

- Microsoft Internet Explorer

- Student information systems SIS

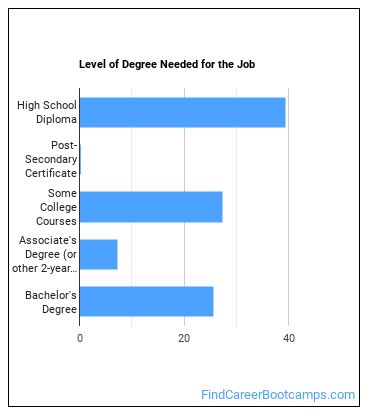

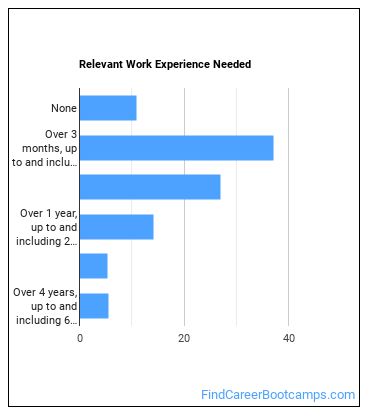

How to Become a Loan Counselor

Education needed to be a Loan Counselor:

How Long Does it Take to Become a Loan Counselor?

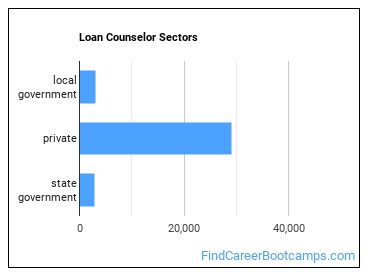

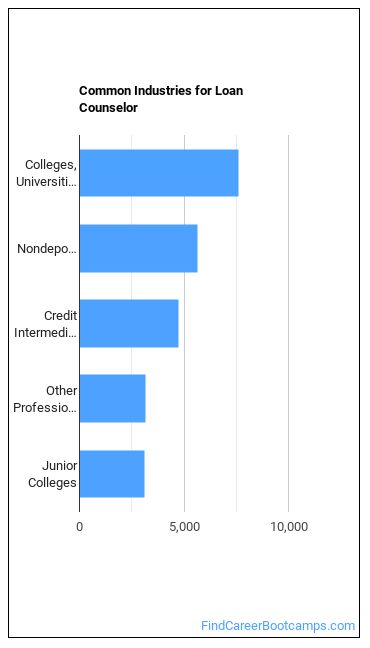

Where Loan Counselors Are Employed

The table below shows the approximate number of Loan Counselors employed by various industries.

Related Careers

Those thinking about becoming a Loan Counselor might also be interested in the following careers:

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.