What Does it Take to Be a Fraud Examiner, Investigator or Analyst?

Occupation Description Obtain evidence, take statements, produce reports, and testify to findings regarding resolution of fraud allegations. May coordinate fraud detection and prevention activities.

Fraud Examiner, Investigator or Analyst Responsibilities

- Coordinate investigative efforts with law enforcement officers and attorneys.

- Advise businesses or agencies on ways to improve fraud detection.

- Evaluate business operations to identify risk areas for fraud.

- Review reports of suspected fraud to determine need for further investigation.

- Recommend actions in fraud cases.

- Research or evaluate new technologies for use in fraud detection systems.

What Skills Do You Need to Work as a Fraud Examiner, Investigator or Analyst?

Fraud Examiners, Investigators and Analysts state the following job skills are important in their day-to-day work.

Writing: Communicating effectively in writing as appropriate for the needs of the audience.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Speaking: Talking to others to convey information effectively.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Other Fraud Examiner, Investigator or Analyst Job Titles

- Fraud Analyst

- Confidential Investigator

- Certified Fraud Examiner

- Risk Analyst

- Fraud Prevention Analyst

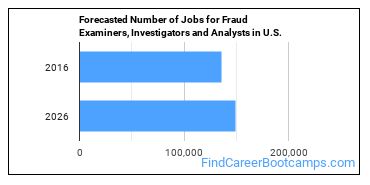

What Kind of Fraud Examiner, Investigator or Analyst Job Opportunities Are There?

In the United States, there were 135,900 jobs for Fraud Examiner, Investigator or Analyst in 2016. New jobs are being produced at a rate of 9.6% which is above the national average. The Bureau of Labor Statistics predicts 13,100 new jobs for Fraud Examiner, Investigator or Analyst by 2026. There will be an estimated 13,100 positions for Fraud Examiner, Investigator or Analyst per year.

The states with the most job growth for Fraud Examiner, Investigator or Analyst are Utah, Nevada, and Arizona. Watch out if you plan on working in South Dakota, Maryland, or Alaska. These states have the worst job growth for this type of profession.

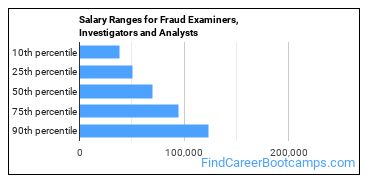

Average Fraud Examiners, Investigators and Analysts Salary

Fraud Examiners, Investigators and Analysts make between $38,030 and $123,360 a year.

Fraud Examiners, Investigators and Analysts who work in District of Columbia, Virginia, or Illinois, make the highest salaries.

How much do Fraud Examiners, Investigators and Analysts make in each U.S. state?

| State | Annual Mean Salary |

|---|---|

| Alabama | $75,170 |

| Alaska | $68,040 |

| Arizona | $82,200 |

| Arkansas | $43,580 |

| California | $80,720 |

| Colorado | $83,800 |

| Connecticut | $77,690 |

| Delaware | $80,950 |

| District of Columbia | $107,760 |

| Florida | $67,520 |

| Georgia | $85,610 |

| Idaho | $56,440 |

| Illinois | $93,200 |

| Indiana | $66,590 |

| Iowa | $69,480 |

| Kansas | $55,300 |

| Kentucky | $57,030 |

| Louisiana | $61,170 |

| Maine | $65,430 |

| Maryland | $77,440 |

| Massachusetts | $88,370 |

| Michigan | $69,480 |

| Minnesota | $74,190 |

| Mississippi | $63,650 |

| Missouri | $74,050 |

| Montana | $67,820 |

| Nebraska | $79,250 |

| Nevada | $58,150 |

| New Hampshire | $77,670 |

| New Jersey | $81,660 |

| New Mexico | $61,940 |

| New York | $96,480 |

| North Carolina | $76,050 |

| North Dakota | $77,400 |

| Ohio | $78,960 |

| Oklahoma | $72,520 |

| Oregon | $71,980 |

| Pennsylvania | $74,880 |

| Rhode Island | $77,610 |

| South Carolina | $69,340 |

| South Dakota | $53,080 |

| Tennessee | $65,200 |

| Texas | $70,830 |

| Utah | $69,340 |

| Vermont | $72,600 |

| Virginia | $87,810 |

| Washington | $73,790 |

| West Virginia | $68,180 |

| Wisconsin | $60,120 |

| Wyoming | $59,190 |

What Tools do Fraud Examiners, Investigators and Analysts Use?

Below is a list of the types of tools and technologies that Fraud Examiners, Investigators and Analysts may use on a daily basis:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- Microsoft Outlook

- Microsoft Access

- Data entry software

- Microsoft Visio

- Microsoft SharePoint

- Structured query language SQL

- SAS

- Microsoft SQL Server

- R

- LexisNexis

- Tableau

- SAP Business Objects

- Symantec

- Splunk Enterprise

- Bookkeeping software

- Electronic health record EHR software

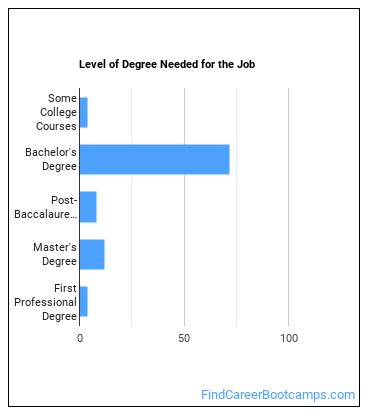

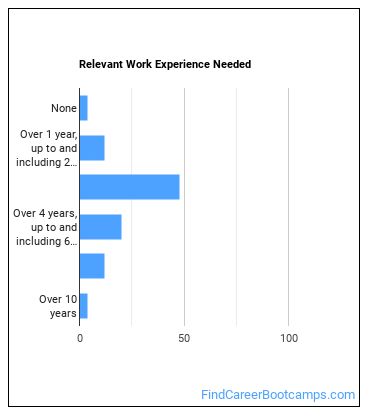

Becoming a Fraud Examiner, Investigator or Analyst

What kind of Fraud Examiner, Investigator or Analyst requirements are there?

How many years of work experience do I need?

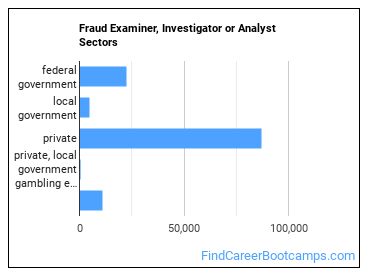

Where do Fraud Examiners, Investigators and Analysts Work?

Fraud Examiners, Investigators and Analysts work in the following industries:

References:

Image Credit: Dave Dugdale via Creative Commons Attribution-Share Alike 2.0 Generic

More about our data sources and methodologies.