All About Credit Analysts

Career Description Analyze credit data and financial statements of individuals or firms to determine the degree of risk involved in extending credit or lending money. Prepare reports with credit information for use in decision making.

A Day in the Life of a Credit Analyst

- Analyze credit data and financial statements to determine the degree of risk involved in extending credit or lending money.

- Complete loan applications, including credit analyses and summaries of loan requests, and submit to loan committees for approval.

- Evaluate customer records and recommend payment plans, based on earnings, savings data, payment history, and purchase activity.

- Compare liquidity, profitability, and credit histories of establishments being evaluated with those of similar establishments in the same industries and geographic locations.

- Generate financial ratios, using computer programs, to evaluate customers’ financial status.

- Consult with customers to resolve complaints and verify financial and credit transactions.

What a Credit Analyst Should Know

Below is a list of the skills most Credit Analysts say are important on the job.

Critical Thinking: Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions or approaches to problems.

Active Learning: Understanding the implications of new information for both current and future problem-solving and decision-making.

Active Listening: Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times.

Judgment and Decision Making: Considering the relative costs and benefits of potential actions to choose the most appropriate one.

Speaking: Talking to others to convey information effectively.

Reading Comprehension: Understanding written sentences and paragraphs in work related documents.

Related Job Titles for this Occupation:

- Factorer

- Analyst

- Loan Officer

- Credit Administrator

- Credit Analyst

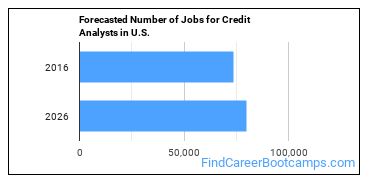

Is There Going to be Demand for Credit Analysts?

There were about 73,800 jobs for Credit Analyst in 2016 (in the United States). New jobs are being produced at a rate of 8.3% which is above the national average. The Bureau of Labor Statistics predicts 6,100 new jobs for Credit Analyst by 2026. Due to new job openings and attrition, there will be an average of 6,800 job openings in this field each year.

The states with the most job growth for Credit Analyst are Utah, Arizona, and Nevada. Watch out if you plan on working in Wyoming, West Virginia, or Vermont. These states have the worst job growth for this type of profession.

What is the Average Salary of a Credit Analyst

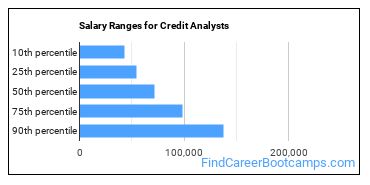

Credit Analysts make between $43,100 and $137,610 a year.

Credit Analysts who work in District of Columbia, New York, or Virginia, make the highest salaries.

Below is a list of the median annual salaries for Credit Analysts in different U.S. states.

| State | Annual Mean Salary |

|---|---|

| Alabama | $80,900 |

| Arizona | $63,710 |

| Arkansas | $60,540 |

| California | $89,430 |

| Colorado | $76,870 |

| Connecticut | $93,970 |

| Delaware | $68,010 |

| District of Columbia | $108,420 |

| Florida | $81,410 |

| Georgia | $70,040 |

| Hawaii | $82,580 |

| Idaho | $63,950 |

| Illinois | $77,800 |

| Indiana | $61,790 |

| Iowa | $68,680 |

| Kansas | $68,720 |

| Kentucky | $75,160 |

| Louisiana | $63,690 |

| Maine | $69,420 |

| Maryland | $70,150 |

| Massachusetts | $84,020 |

| Michigan | $71,070 |

| Minnesota | $81,070 |

| Mississippi | $60,220 |

| Missouri | $75,620 |

| Montana | $71,890 |

| Nebraska | $64,420 |

| Nevada | $70,540 |

| New Hampshire | $84,250 |

| New Jersey | $85,030 |

| New Mexico | $61,500 |

| New York | $119,180 |

| North Carolina | $84,530 |

| North Dakota | $65,200 |

| Ohio | $77,510 |

| Oklahoma | $57,940 |

| Oregon | $74,520 |

| Pennsylvania | $80,710 |

| Rhode Island | $75,050 |

| South Carolina | $67,070 |

| South Dakota | $62,210 |

| Tennessee | $64,380 |

| Texas | $81,540 |

| Utah | $68,920 |

| Vermont | $77,670 |

| Virginia | $85,090 |

| Washington | $76,500 |

| West Virginia | $61,140 |

| Wisconsin | $70,550 |

| Wyoming | $57,460 |

What Tools do Credit Analysts Use?

Although they’re not necessarily needed for all jobs, the following technologies are used by many Credit Analysts:

- Microsoft Excel

- Microsoft Word

- Microsoft Office

- Microsoft PowerPoint

- SAP

- Structured query language SQL

- SAS

- Microsoft Dynamics

- Microsoft Visual Basic

- Microsoft SQL Server

- Oracle JD Edwards EnterpriseOne

- Oracle Business Intelligence Enterprise Edition

- CGI-AMS BureauLink Enterprise

- Experian Credinomics

- Moody’s KMV CreditEdge

- Fair Isaac Capstone Decision Manager

- Experian Retention Triggers

- Fair Isaac Application Risk Model Software

- Experian Quest

- Fair Isaac Falcon ID

How to Become a Credit Analyst

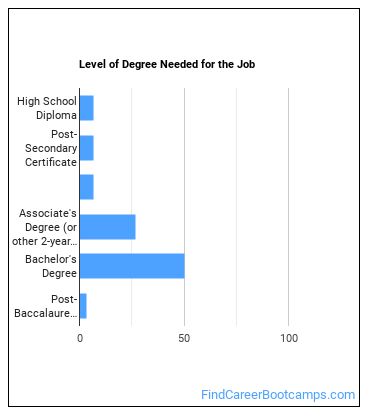

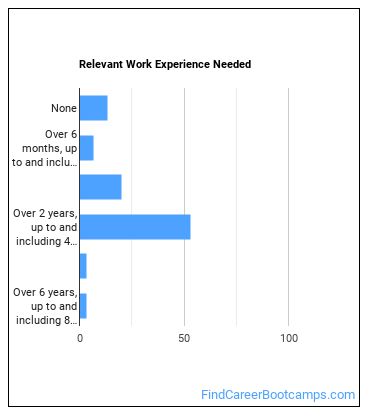

What education or degrees do I need to become a Credit Analyst?

How Long Does it Take to Become a Credit Analyst?

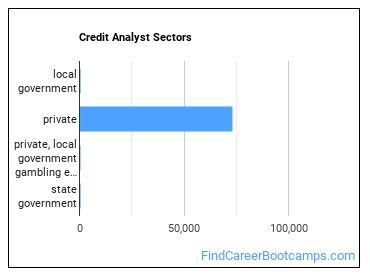

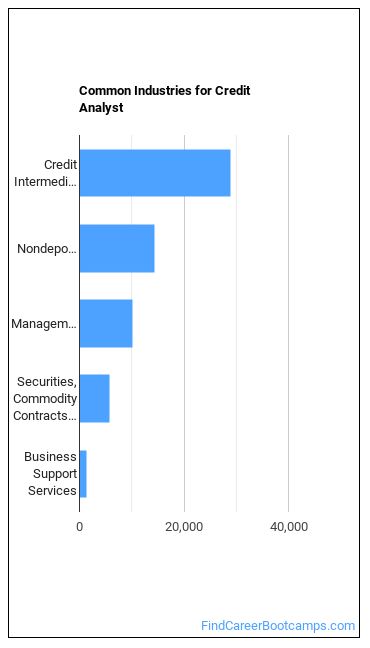

Where Credit Analysts Are Employed

Below are examples of industries where Credit Analysts work:

You May Also Be Interested In…

Those thinking about becoming a Credit Analyst might also be interested in the following careers:

Are you already one of the many Credit Analyst in the United States? If you’re thinking about changing careers, these fields are worth exploring:

References:

Image Credit: Pixabay via CC0 License

More about our data sources and methodologies.